GUIDE TO BUYING A HOME

“Buying a home usually represents a persons biggest single investment – and debt. We’ve painstakingly developed the ultimate road map every buyer should read before buying a home in Alberta”

Hello, thank you for taking a moment to review the following step by step guide to buying a home in Alberta! In the following 6 Easy Steps below you’ll find a quick overview of the AlbertaRE Real Estate team Buyer Guide, a 50+ page e-book we’ve diligently wrote that breaks down the entire process of buying property in Alberta.

You’ll find the 6 Steps every buyer should read prior to buying a home in Alberta itemized below. We promise, these 6 steps will give you a Great Start!

Our full guide on the other hand – will give you a Great Advantage as it is literally chalked full of Real Estate buying hacks and strategies to help ensure you’re in a Position of Power when buying property in Alberta.

If after reading the below brief introductory to our guide you feel you’d receive exceptional value in receiving the entire 50+ page e-book (which includes all of our team’s top negotiation strategies and insider views to constructing a purchase contract term by term to absolutely ensure you position your offer in the most advantageous way possible) Contact Us and we will be happy to email you the report! Happy Buying! 🙂

6 Steps every buyer should read prior to buying a home in Alberta.

1.) Define your goals, research your options, and make your plans

Having a plan in place is the best place to start. Remember, you’re not just buying a home, you’re buying a place you’re going to live! This means you’ve got to enjoy the lifestyle it offers. It’s important to know what’s most important to you – Do you travel often? Maybe a lock and go condo with no maintenance is the best choice. Do you have kids? A dog? Maybe a single family home with a large yard close to a park and schools is a better choice.

Always Keep Location Top of Mind!

Whether you’ve decided to build new or buy resale, location should be your #1 priority. With a new home in a suburban area, make sure you are keeping resale in mind and try to build in one of the better phases, on one of the choice lots within that phase.

With resale try to remember that any negative associated with the property that you cannot change will likely be negatives when you try and sell in the future. Backing a busy road or gas station might not bother you, but you can be sure it will bother 90% of the buyers in the future if/when you try to sell.

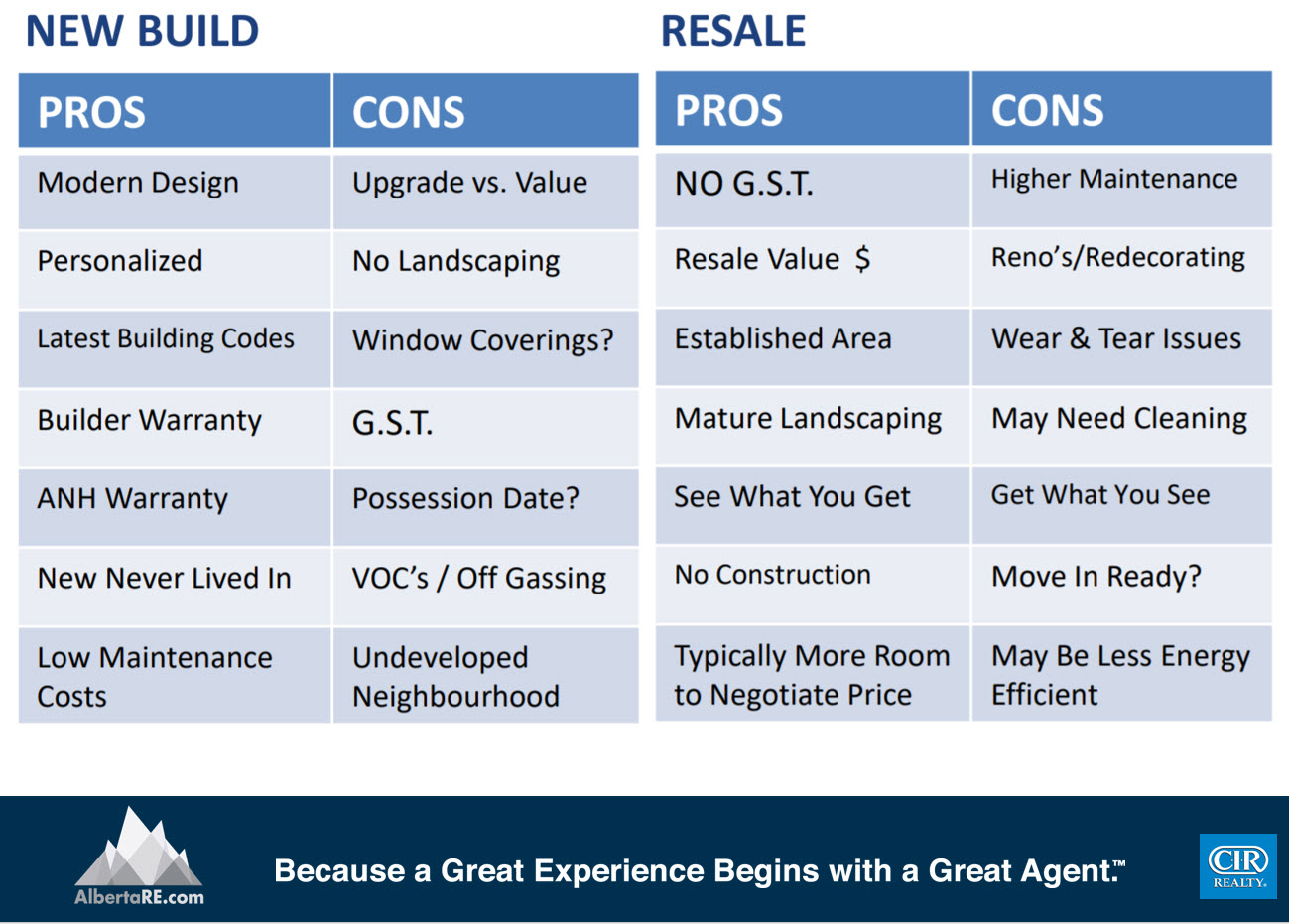

There are Pros and Cons to both building new or buying a resale home. It is important to get clear on what works best for your situation. When building new you will have to be flexible on your possession date/move in day and be able to adjust your plans as your build gets closer to being complete. With Resale you can pinpoint the exact day and time you’d like to take possession of your new home.

Here is a quick chart itemizing some of the more common Pros and Cons associated with both New homes and Resale.

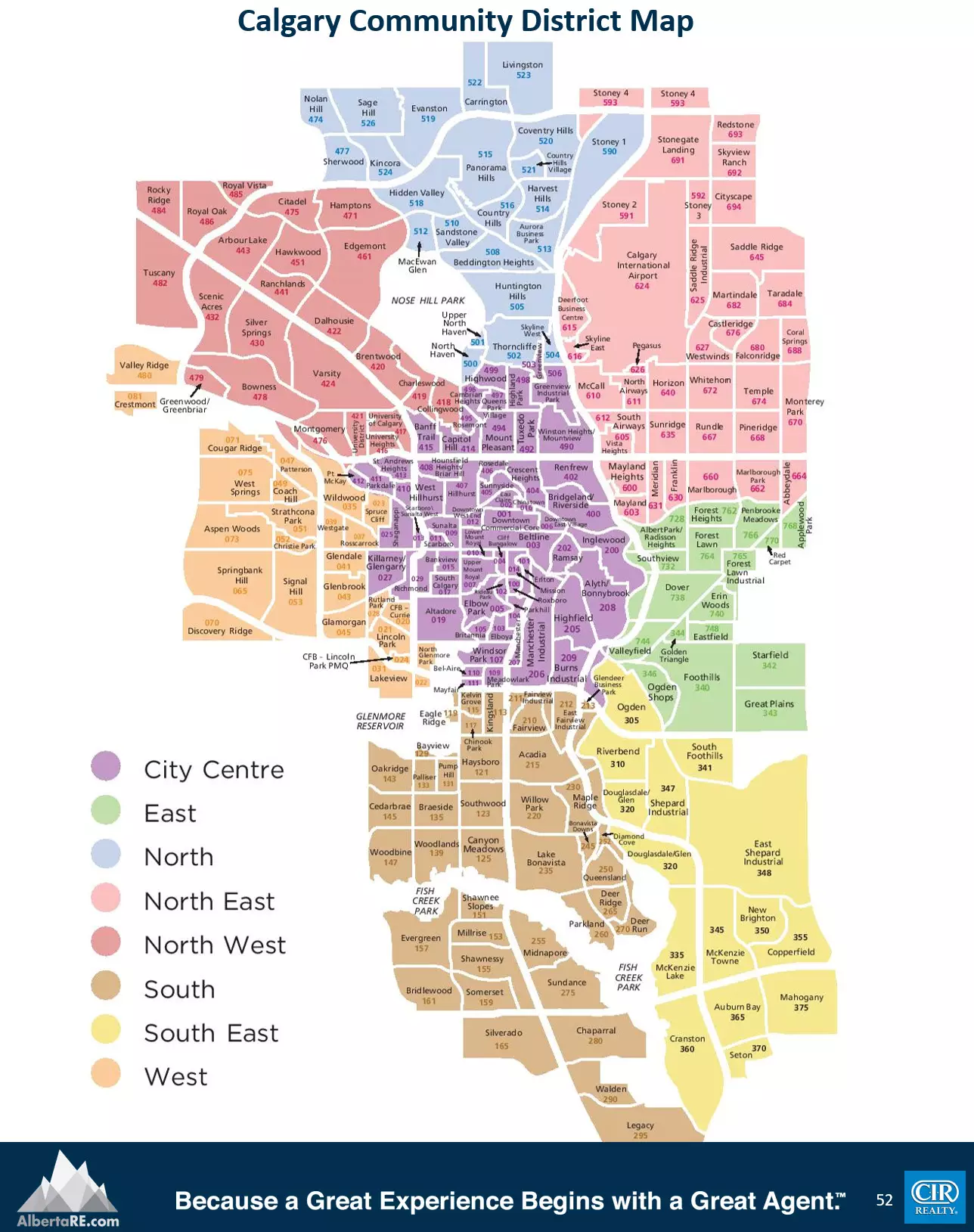

Be sure you’re selecting a location that best suite your needs and lifestyle. Think about where you work, where your family lives, where your friends live, and the proximity to important amenities or activities you may use or do frequently (YYC Airport, Downtown, Fish Creek Park, Glenmore Reservoir, Church, Gym, Rec Centre, Access to the Mountains, Schools and Universities etc.)

2.) Establish Your Budget

Once you’ve defined the best location for your lifestyle you’ll need to consider what can you afford without breaking the bank!

As a general guideline, total monthly housing costs for your primary home, including mortgage payments, taxes, maintenance fees, insurance, interest charges and utilities – should not exceed 32 percent of your gross monthly income. Many financial advisers suggest that the total monthly debt, including mortgage payments, credit cards and car payments should not exceed 40 percent of your income.

If you are interested in purchasing a real estate investment property, we recommend that you consult your real estate and financial adviser to understand the tax and financial implications of your purchase.

Many lenders will require 20 percent of the total purchase price for an investment property,

Keep in mind you will need to purchase mortgage loan insurance that guarantees the debt against default if your down payment is less than 20 percent. In most cases, this can be added to the mortgage loan.

3.) Get pre-approved for a mortgage

Once you determine what you can afford, you can have your lender provide a pre-approval letter for your mortgage. A pre-approval can lock in an interest rate for a set period of time while you are house hunting. The typical period is around 60-120 days, 120-180 days being more common if you are planning a new build in which case some lenders will lock a rate in for a longer period of time.

The best part of getting a pre-approval is that there is no obligation for you to stick with the rate or the lender that gave it to you. You can always renew your pre-approval at the current interest rate being offered if you don’t find a home within the time period. Another plus, if rates go down between the time you get pre-approved and when you find a home, you will get the lower rate. If rates go up during your pre-approval period, you still get the lower rate. Win, Win. ?

*Important to note, a pre-approval does not guarantee a mortgage. Changes in employment, credit or the house you choose can effect the mortgage approval.

Open vs. Closed Mortgage:

Open mortgages can generally be paid off at any time without compensation. They are suited to homeowners who are planning to sell in the near future or those who want the flexibility to make a large, lump-sum payments before maturity.

Closed mortgages are commitments for a specific term. If you want to pay off the mortgage balance, you will need to wait until the maturity date or pay compensation for doing prior to the end of the term, this is often referred to as a payout penalty.

Amortization:

Amortization is the length of time the entire mortgage debt will be repaid. Many mortgages in Canada are amortized over 25 years, but longer periods are available. The longer the amortization, the lower your scheduled payments but the more interest you will pay over the long run.

Conventional vs. High Ratio Mortgage:

A conventional mortgage is a mortgage loan that is equal to or less than 80% of the lending value of the property. The lending value is the property’s purchase price or the market value – whichever is less. A high-ratio mortgage has a down payment of less than 20% of the homes price.

A high-ratio mortgage usually requires mortgage loan insurance. Your lender may add the loan insurance premium to your mortgage or ask you to pay in full upon closing.

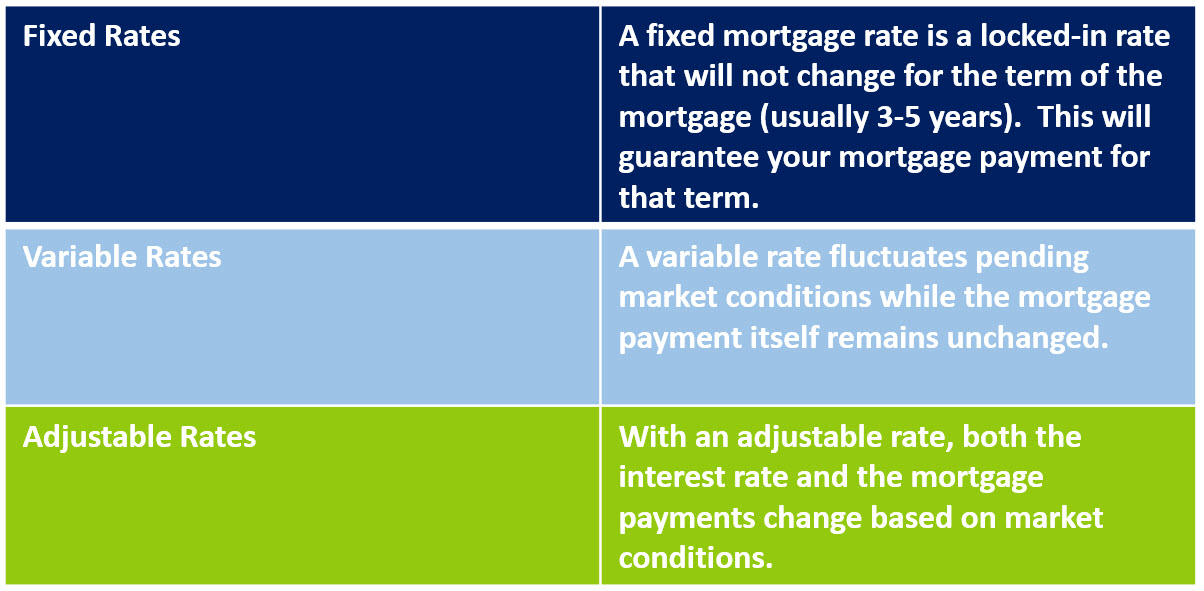

Mortgage Term:

The term is the length of time that the mortgage contract conditions, including interest rate, are fixed. The term can be six months to ten years. It is important to consider term options as you many receive a lower rate on a shorter term but a longer term may protect you from interest rate increases and other favorable terms.

Do you want the contact info for our preferred Mortgage Broker? They represent the best mortgage brokerage team in the entire province, in our humble opinion and we get nothing in return for referring you to them, other than the peace of mind knowing you’ll receive exceptional service. Yes! I’d like to learn more about Mortgage Tree

4.) View homes and select THE ONE

First step in this process prior to viewing homes is to get clear on

What Do You Want? vs. What Do You Need?

An often overlooked step in the home buying process is establishing your wants vs. needs early in the process. Focusing on the criteria that falls into your needs category is the best way to narrow down your search enabling you to find the most suitable property within your preferred geographical area.

Once you’ve narrowed your search down by your needs, you can eliminate properties that aren’t hitting enough of the criteria on your wants list.

Searching for a property in this fashion works well as it separates you from the properties that aren’t going to work very quickly allowing you to focus solely on the ones that will work. This laser focus approach ensures you don’t miss out on the perfect property because you were too busy sifting through and viewing properties that had lot of items on your wants list, but missing some of the more important features on your needs list.

We’ve created an example of a typical needs vs. wants chart for you:

After you’ve gone through this process, you’re ready to start viewing all the properties that fit your needs, wants, location, and budget. Take your time when viewing each property and try to picture yourself living there. What would life look like? Do you get a feeling of comfort while in the home? Anxiety? Does the layout fit your lifestyle? Is the home bright with enough natural light?

3 Questions you need to ask yourself when considering a property

1. Can I afford this home, reasonably? Try not to fall in love with a home that is at the very top of your budget making it a monthly struggle to pay bills and still have a life. This is referred to as being ‘house poor’ as you have a nice home but no money left over for entertainment. This can sometimes happen when looking at properties, this is especially true when a home in the perfect location pops up but needs a renovation, upgrades, or layout changes to make it work for you.

If your answer to the above question was no, you should skip the next two questions and keep looking. If you answered yes, you’re ready to ask yourself the next question.

2. Does the layout work for me? You should already be comfortable with the location of the home, the size, number of beds and baths etc. as you’ve chosen homes to view by narrowing them down with your wants vs. needs list. Now that you’re in a home that matches your criteria enough to warrant a viewing, and you’ve determined it’s well within your affordability comfort zone – Does the layout work?

If you’ve answered Yes to the first two questions, you should be well on your way to having found the perfect home. The last question is a gut check. This is an emotional one, not a logical one like the first two.

3. Does this feel like home? and a good follow up question to this is: Would I be upset if someone else bought this home before me? Asking yourself these questions should present you with a flood of emotion. Is all you have to do is determine whether the emotions you’re feeling are positive ones or negative. A word of caution with this is to be careful not to confuse nervousness for a negative feeling. It’s normal to feel nervous when purchasing a property, it is after all, likely to be one of the largest purchases in your life.

You’ve asked yourself the 3 questions and are feeling good! You’ve found THE ONE! What’s Next?

5.) Make an offer and negotiate with the seller

Once you’ve found the home love, it’s time to make an offer.

This is where having the very best Realtor on your side will pay off. Timing, dates, terms and details all need to be negotiated prior to final signing of the contract.

LEGAL & CONTRACTUAL OBLIGATIONS: In Alberta, an offer commits you to a legal obligation as soon as the other party has accepted it. Prior to submitting an offer, you need to ensure you are clear on the legal obligations you are undertaking if the offer is accepted.

Details to consider for the purchase contract include:

Name(s) of purchaser. You may want to have a company name, or a co-signer on title. This is a good question to ask your mortgage advisor and/or accountant.

Price you’d like to offer. Think of this as a starting point and have a number in mind for the most you’d be willing to pay for the property before going into negotiations.

Amount of deposit. This is typically due within 24 hours of offer acceptance, any additional deposits are due upon removal of conditions all deposits are to be held in a Trust Account which is put towards your total down payment.

Amount of down payment. This will be due to your lawyer prior to possession day. This amount will be the total amount you intend to put down less the amount you’ve already put down in the form of your deposit.

Amount of new mortgage. This amount is typically the final purchase price less your down payment. If you are planning to put down less than 20% you will be required to have mortgage insurance. Mortgage insurance can, and is most often added to your mortgage.

Conditions for the offer. Typical conditions that are favourable to the buyer include: home inspection, financing, and a condominium document review. These are usually removable within 10 days. For more detailed strategies on which conditions you should be considering and why

Dates for conditions to be removed. Be sure to give yourself enough time to get the information you need to make a final decision.

Items to be included in sale. Typical items included are: appliances, built in vacuum systems, A/C units, storage sheds, and water softeners. Other items that can be included are: furniture, hot tubs, art work, and lawn equipment and anything else of value not already attached to the property.

Possession Date. Always consider the date that works best for you when submitting an offer even if the seller is requesting another date. Possession can be a large factor in a negotiation. As a buyer you are in a better position if you’re able to use the possession date as leverage for a more favourable price.

Additional Terms. This section is used to add anything you would like the seller to agree to that isn’t already in the purchase contract. Some terms that are often included are: Any repairs that need to be addressed prior to possession, additional viewings on the property, clean up of any debris on the property and other terms a buyer or seller may want addressed.

6.) The offer has been written and submitted, how do I negotiate?

After the initial offer has been presented to the seller, there are 4 actions that can occur. Any of these can happen more than once during a negotiation all the way up until the offer is accepted with final signing completed by all parties to the contract.

1. Rejecting the offer – The seller may just say no, or if the offer does not get signed, time lapses and the offer becomes null and void.

2. Acceptance of the offer – Offer is accepted and signed by all parties and becomes legally binding.

3. Counter offer – Sellers counter your offer with price, conditions and/or terms more suitable to the seller. These changes will then be presented to you and you can chose to do one of the following: reject, accept or counter the counter offer. All offers in Alberta must be in writing to be considered legally binding, however counter offers are often done verbally initially as it has become common practice in the industry. It is important to note that a verbal counter offer can be reneged at anytime with no consequence so it may be in your best interest to have everything in writing. Once all changes are made and initialed by both parties on the contract and final signing occurs, you then have a legally binding contract to purchase the property.

4. Competing offers – Seller receives multiple offers at the same time. You can chose to withdraw your offer, leave as is, or strategically adjust offer (price, conditions, deposits, possession, and inclusions) to aggressively compete and increase your chances of securing the property.

Want more detail on your best options in any of the 4 given scenarios, along with our full list of negotiation strategies, tips, and comprehensive insight on what terms and conditions to include and exactly how you should write them into the contract to better your position in the negotiation?

It’s all available in our full buyer guide. It’s free, no obligation. Just Contact us here and let us know you’d like us to send it to you! Is all we want in return is for you to consider using someone from our team as your Realtor, allowing us an opportunity to earn your business.

6.5 Extra Bonus Chart on Typical Closing Costs

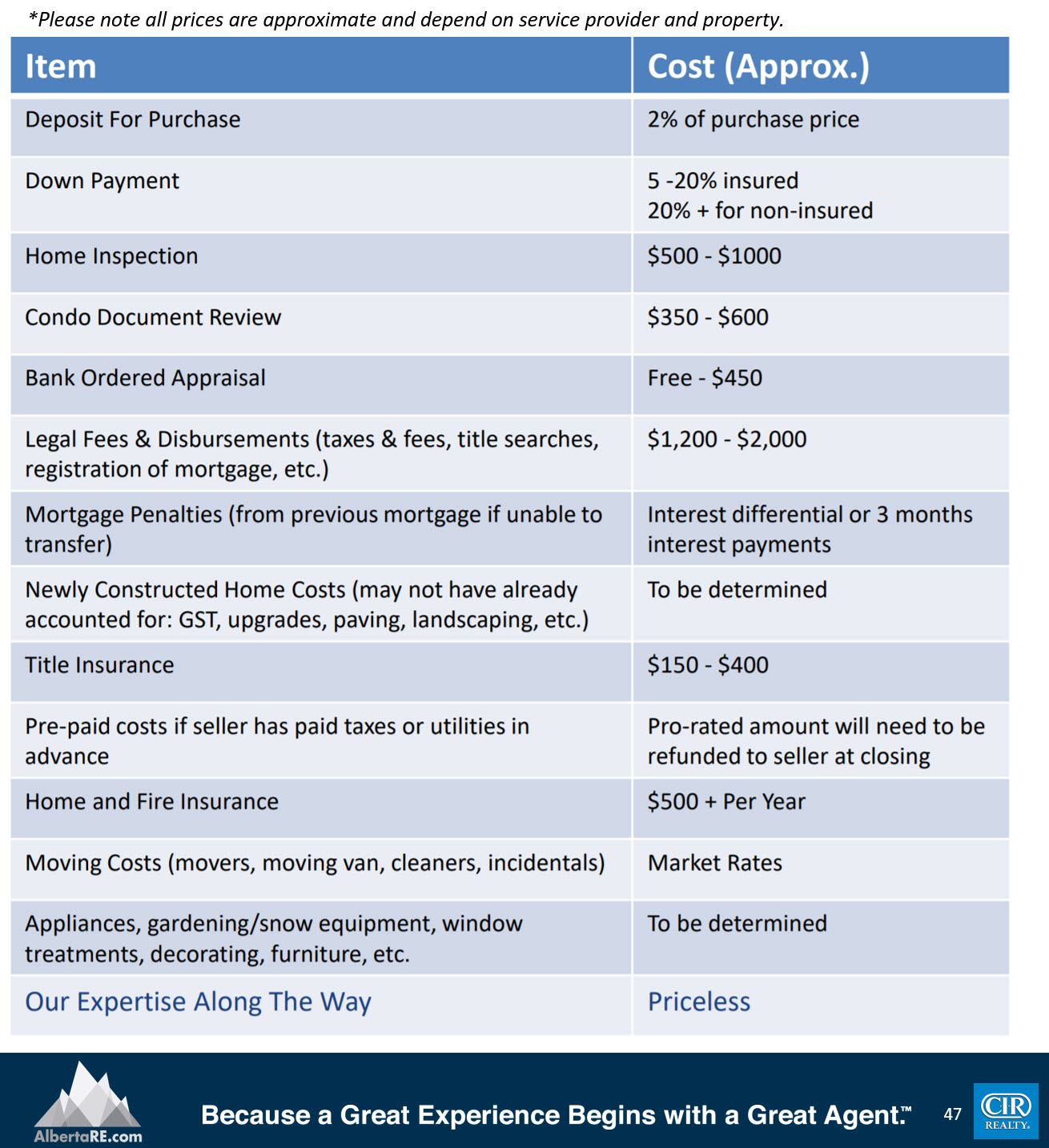

As a thank you for reading (or skipping) all the way to the bottom of our page. We thought we’d throw in a bonus chart itemizing the typical closing costs you can expect to pay as a buyer purchasing a property in Alberta. Unlike many provinces across Canada, Alberta does not have a land transfer tax and G.S.T. is only applicable on new builds, not pre-owned properties.

Here is a list of some of the more typical costs you may come across in the purchase of your home. Not all of these will apply to you, many are situational. You’ll note that there are no commissions listed as this is typically not the responsibility of the buyer to pay, in the majority of all transactions across Alberta the seller is responsible for compensating both the Listing Realtor AND the Buyer Realtor commissions. ?

If you’d like further explanation on any of these costs itemized below, don’t hesitate to ask.

*Please note all prices are approximate and depend on service provider and property.

Want our full guide? With all our best tips and hacks for buying homes in Alberta?